AllRecipe.Org: Your Trusted Source for Healthful Living Through Food

At AllRecipe.Org, we believe that food is more than just nourishment; it’s the foundation of a vibrant, healthy life. Our mission is to empower individuals to make informed choices about the foods they eat by providing a trusted source for healthy recipes, culinary inspiration, and dietary guidance. With a unique focus on doctor-prescribed and health-conscious recipes, AllRecipe.Org brings you closer to achieving wellness goals through the power of wholesome and carefully curated food selections.

Our Vision: Nourish to Flourish

In a world filled with diet trends, quick-fix solutions, and confusing nutritional advice, we aim to cut through the noise. At AllRecipe.Org, our vision is simple: to inspire healthier lifestyles by making nutrient-rich foods accessible, enjoyable, and easy to prepare. Every recipe, whether designed to boost energy levels, support weight management, or promote heart health, is crafted with your well-being in mind. Our holistic approach to food is built on the principle that what you eat matters, and by choosing nutritious meals, you take the first step toward a healthier, happier life.

What Makes Us Unique? Doctor-Prescribed Recipes

The medical field continuously discovers new links between food and health, and at AllRecipe.Org, we keep pace with these advancements. Many of our recipes are inspired by doctor-prescribed dietary guidelines. Working with health experts, we ensure that each dish aligns with specific health goals, such as improving heart health, managing diabetes, or enhancing immune function. This approach allows you to follow recipes with the confidence that they are backed by evidence-based recommendations tailored for a healthier life.

Curated for Every Health Journey

Health needs vary from person to person, and we believe in celebrating that diversity. At AllRecipe.Org, we feature recipes tailored to different dietary requirements and personal wellness goals. Our blog includes sections dedicated to various health concerns, such as:

– Heart Health: Recipes designed to lower cholesterol and blood pressure.

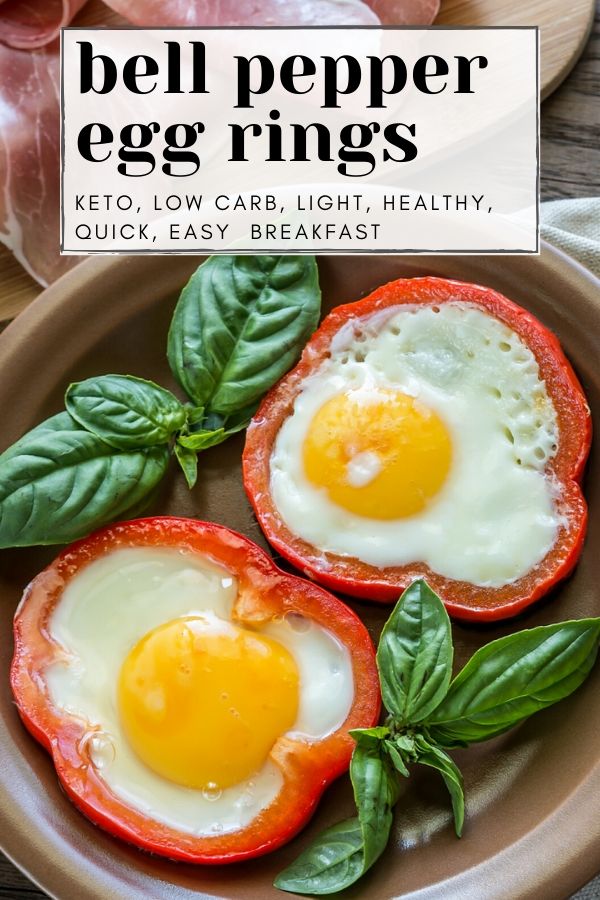

– Diabetes Management: Low-carb, low-glycemic recipes to manage blood sugar levels.

– Weight Loss: Calorie-conscious recipes that satisfy without compromising on flavor.

– Immune Support: Nutrient-dense recipes packed with vitamins and minerals to help fortify your immune system.

– Digestive Wellness: Recipes that are gentle on the stomach and support a balanced gut microbiome.

Our goal is to make these recipes not only beneficial but also enjoyable. After all, a health journey is sustainable only if it’s satisfying.

Backed by Science, Driven by Flavor

Healthy eating should never mean sacrificing flavor. Our team of culinary experts, nutritionists, and health consultants work tirelessly to make each recipe both nutritious and delicious. Drawing from a range of cuisines and cooking styles, we ensure that the dishes you find on AllRecipe.Org reflect a balance of health and taste. Every ingredient is carefully selected not just for its nutritional profile but for its ability to enhance the dish’s flavor, aroma, and texture.

Embracing Food Diversity and Seasonal Eating

At AllRecipe.Org, we celebrate the diversity of global cuisine and the benefits of seasonal ingredients. We bring you recipes inspired by various cultures, each offering unique health benefits. Eating seasonally is also a priority for us because fresh, in-season produce offers the best flavors and nutritional values. By focusing on seasonal recipes, we help you connect with the rhythms of nature, encouraging a lifestyle that is both health-conscious and environmentally friendly.

Education at the Core: Tips, Articles, and Nutritional Guides

Healthy eating is a journey, and we’re here to guide you every step of the way. Alongside our recipes, we publish articles that delve into the science of nutrition, common dietary myths, and the latest research on food and health. You’ll find tips on meal planning, grocery shopping, and even food storage, making it easier to maintain a nutritious diet in a busy world. We believe that understanding the “why” behind your food choices is just as important as the choices themselves, so each recipe comes with a nutritional breakdown and information on the specific health benefits of its ingredients.

Community-Centric Approach: Sharing Stories and Celebrating Success

Health journeys are often unique, and so are the stories that come with them. AllRecipe.Org isn’t just a recipe site; it’s a community. Our platform offers a space for readers to share their experiences, triumphs, and even challenges in adopting a healthier diet. Through our blog’s comments section, social media channels, and occasional success stories, we celebrate your achievements and foster a supportive environment where everyone feels encouraged to make positive lifestyle changes.

Accessible and Inclusive Recipes for All

We recognize that healthful living should be accessible to everyone. That’s why our recipes cater to a range of dietary needs, including vegetarian, vegan, gluten-free, dairy-free, and allergy-friendly options. We also ensure that each recipe is approachable, with straightforward instructions and readily available ingredients. No matter your background or level of culinary expertise, you’ll find recipes on AllRecipe.Org that fit seamlessly into your lifestyle.

Why AllRecipe.Org?

Here’s what sets us apart as a leading resource for health-conscious recipes:

1. Expert-Driven Content: Our recipes and articles are crafted in collaboration with health and culinary professionals, ensuring that the information is accurate, relevant, and beneficial.

2. Evidence-Based Recipes: Many of our recipes are based on doctor-prescribed diets and recommendations, giving you peace of mind that your meals support your health goals.

3. Focus on Long-Term Wellness: We emphasize sustainable, balanced eating rather than restrictive diets, supporting you in making lifestyle changes that last.

4. Community and Support: We believe in the power of a supportive community. AllRecipe.Org is a place to share, learn, and grow together.

5. Seasonal and Global Inspiration: Our recipes are inspired by diverse culinary traditions and seasonal ingredients, promoting a rich and varied diet that’s as beneficial as it is delicious.

Join Us on Your Health Journey

At AllRecipe.Org, we invite you to join us on a journey towards better health, one delicious recipe at a time. Whether you’re looking to prevent health issues, manage an existing condition, or simply embrace a more balanced diet, we’re here to guide you. With recipes that cater to your specific needs and insights that empower you to make informed choices, AllRecipe.Org is committed to being your trusted companion in the kitchen and beyond.

Embrace the flavors of health with us. Discover the difference that nutrient-rich, thoughtfully prepared meals can make in your life, and start cooking for wellness today!

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link

Link